The app economy slowed for the first time in history in 2022, but has picked up pace again this past year. According to an annual report from data.ai, an app intelligence provider.“Current State of Mobile” report, Announced today, consumer spending on apps grew by just 3% year-over-year in 2023, reaching $171 billion across Chiana’s App Store, Google Play, and third-party Android app stores. Thanks in part to the success of TikTok, more of the total consumer spending is coming from apps rather than mobile games. However, the number of app downloads last year remained flat at 257 billion, an increase of only about 1% from the previous year.

In 2022, the unstoppable growth of the app economy finally put an end to the post-COVID-19 slump as consumer spending normalized and the economic downturn caused more people to tighten their wallets. Calculations on the back of the napkin Apple’s App Store even hinted that consumer spending may be slowing, but could not give an exact number because Apple’s transaction percentage is no longer a flat 30%.

According to data.ai, things were looking up again last year.

Consumer spending on non-gaming apps grew 11% year over year in 2023 to reach $64 billion. Social apps and the creator economy are driving this growth, with TikTok leading the way. For example, the short-form video app reached a new milestone last year, surpassing his $10 billion in lifetime spending, making it the first non-gaming app to achieve such a milestone. data.ai predicts that consumer monetization in social apps will increase by 150% to $1.3 billion this year.

Image credits: data.ai

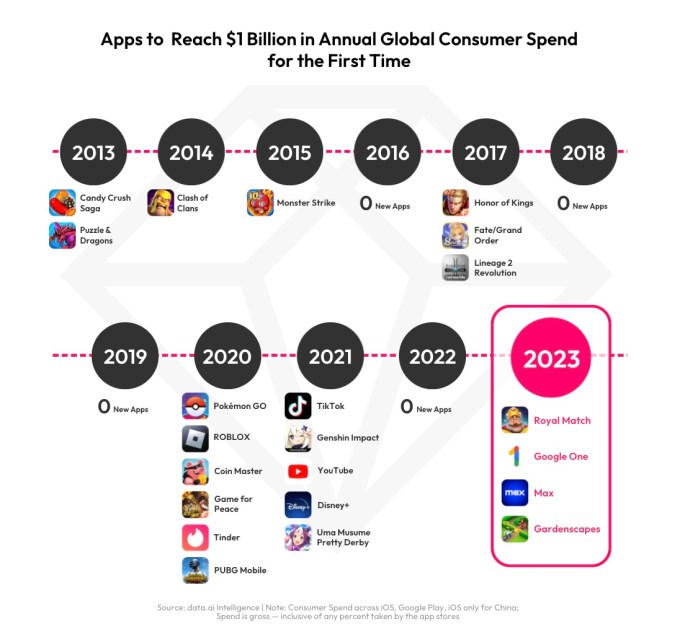

Elsewhere, more than 1,500 apps and games generated more than $10 million annually in 2023. There were 219 deals that exceeded $100 million and 13 that exceeded $1 billion. This year, four new apps reached his $1 billion mark, including Royal Match, Google One, Max, and Gardenscapes.

Image credits: data.ai

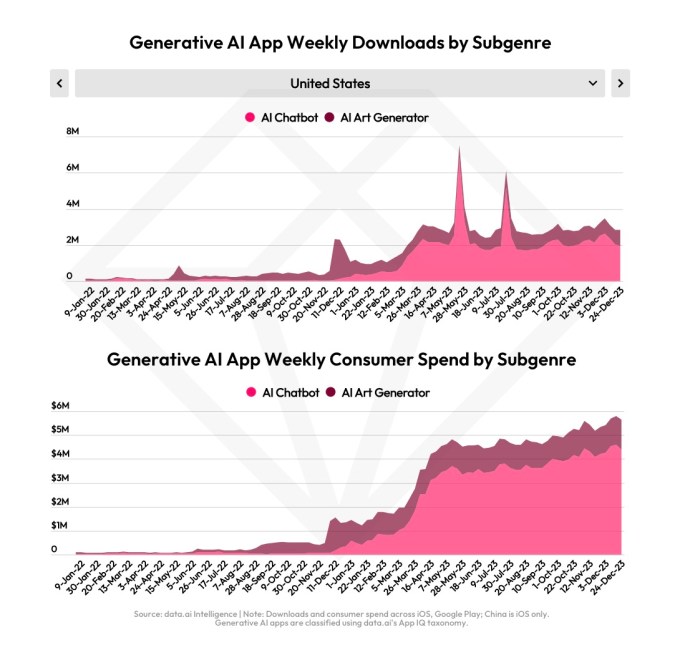

The company also cited advances in generation AI for driving consumer spending last year. The genAI app market has expanded seven times over his time, leading to new consumer experiences such as AI chatbots and AI art generators. Top apps in terms of consumer spending included ChatGPT, Ask AI, and Open Chat. Data.ai noted that while the popularity of AI apps is “fairly global,” the genre doesn’t rank among the breakout genres in China, Japan, Saudi Arabia, or Turkey.

Image credits: data.ai

To capitalize on consumer demand, more than 4,000 apps have added the word “chatbot” to their app descriptions and more than 3,500 have added “gpt,” according to data.ai. Additionally, in 2023, he said 2,500 apps will be released that include “chatbot” in their description. The company says this is nearly double the number of apps released in the past four years combined.

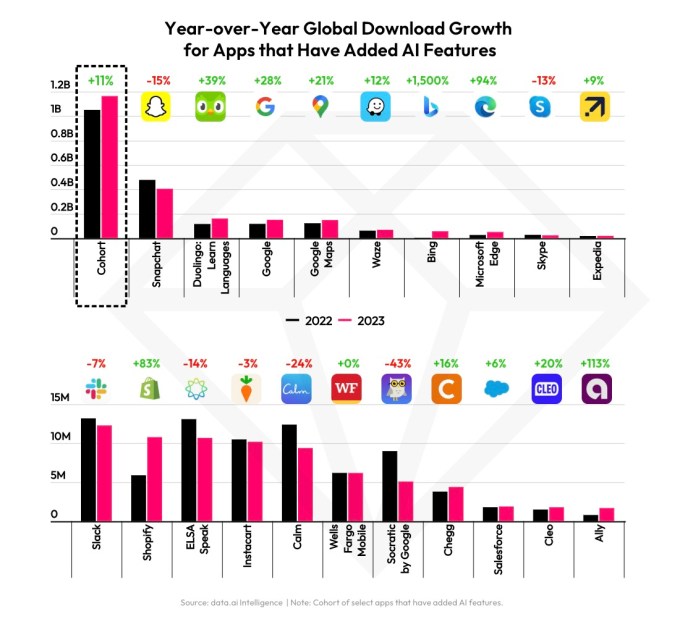

Apart from AI apps themselves, other apps with AI features also performed well in 2023.

A study by data.ai found that downloads of the 20 apps that added such features increased by 11% year over year. 13 out of 20 (65%) also showed positive growth.

Image credits: data.ai

The full report also delves into other metrics about the health of the app ecosystem, including installs, time spent, ad spend, and game-specific details.

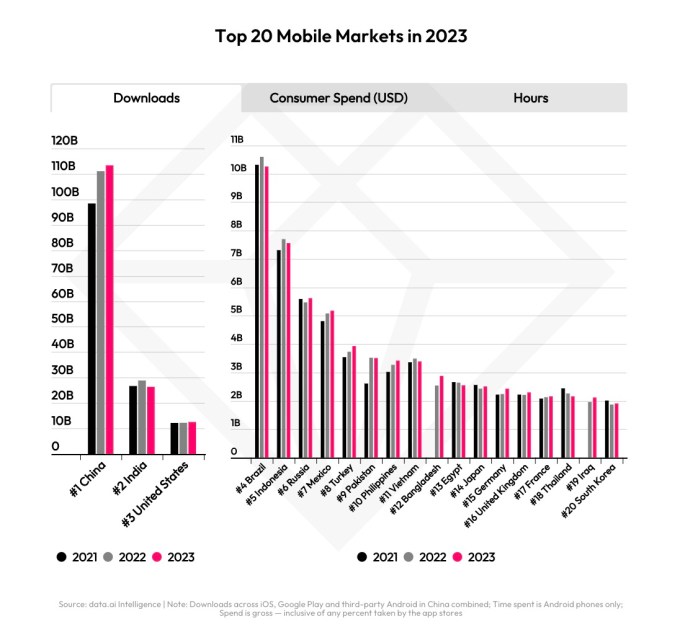

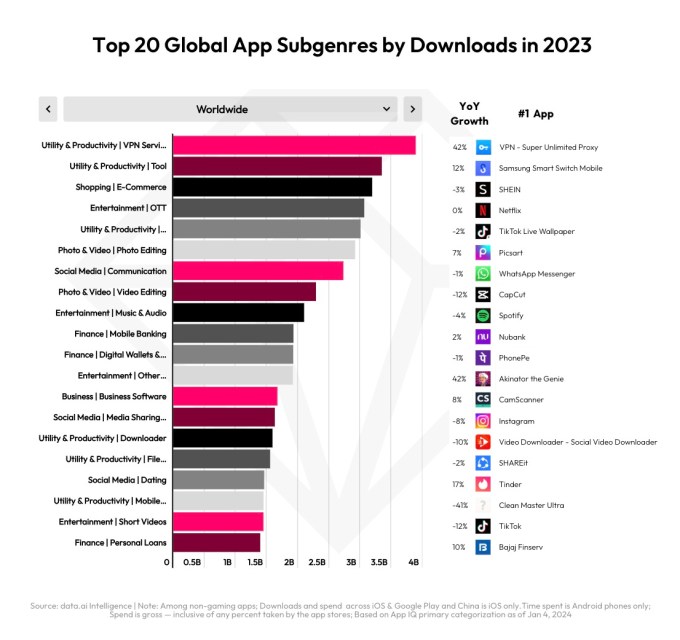

Last year, China led India (2nd place) and the US (3rd place) in app installs, while Bangladesh emerged as the fastest growing market. App subgenres include utilities, productivity apps, shopping, entertainment, photos and videos, and more.

Image credits: data.ai

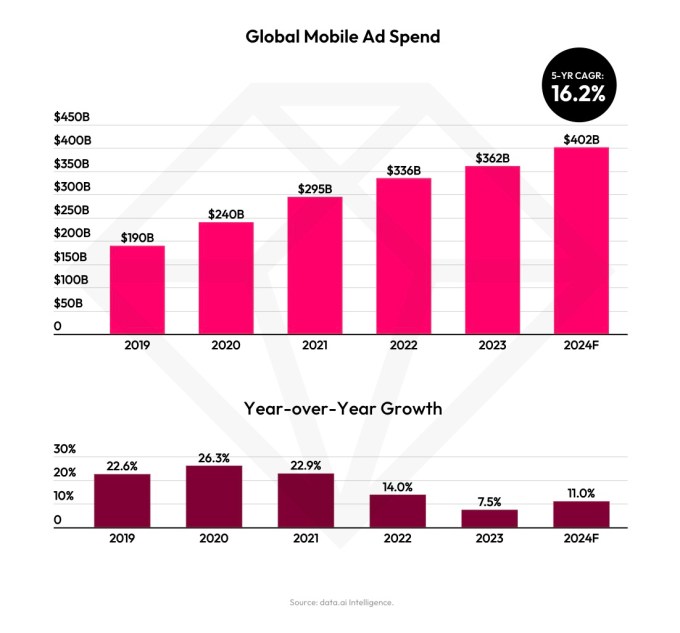

Data.ai also reports that time spent peaked at $5.1 trillion, up 6% year over year, and mobile ad spending is expected to grow 8% this year to $362 billion. Masu. Data.ai estimates that 2024 is expected to see an even bigger jump of 16.2%, reaching $402 billion, as ad spending recovers from slowing growth in 2023.

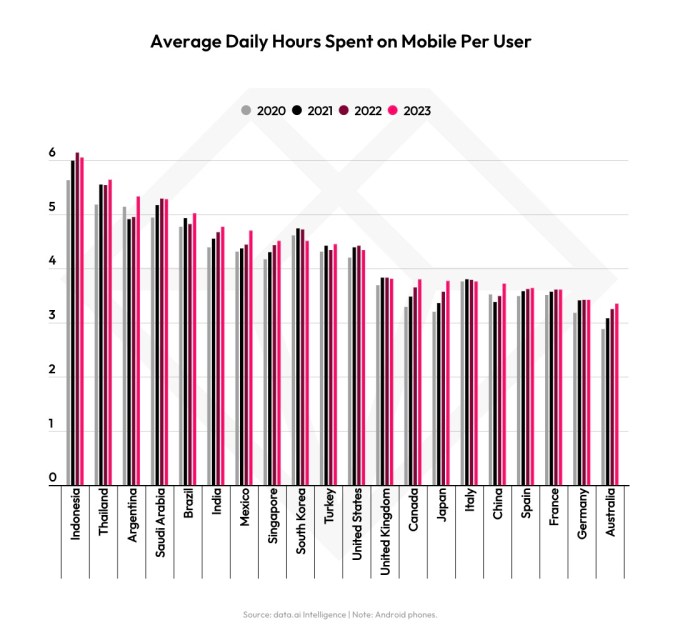

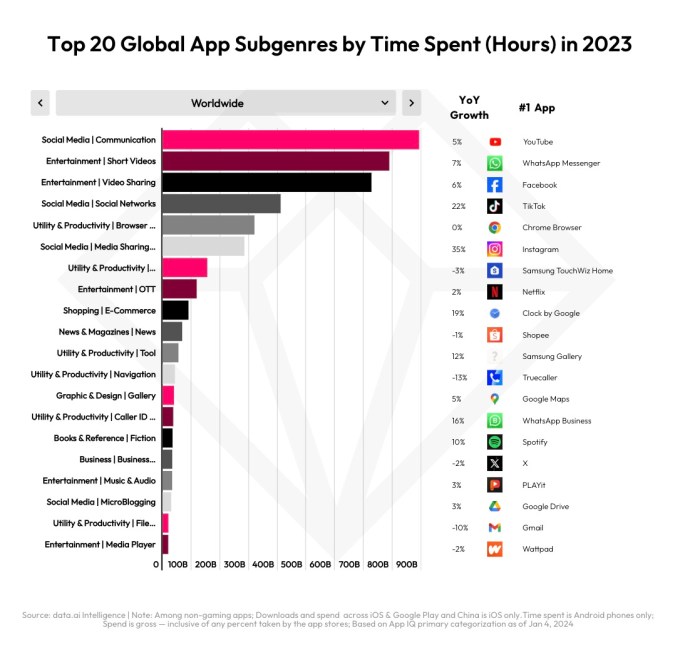

Meanwhile, across the top 10 markets, average daily mobile time per user increased by 6% from 2022 to more than 5 hours. Here, apps like YouTube, WhatsApp, Facebook, TikTok, Chrome, Instagram, and Netflix helped increase dwell time.

Image credits: data.ai

Image credits: data.ai

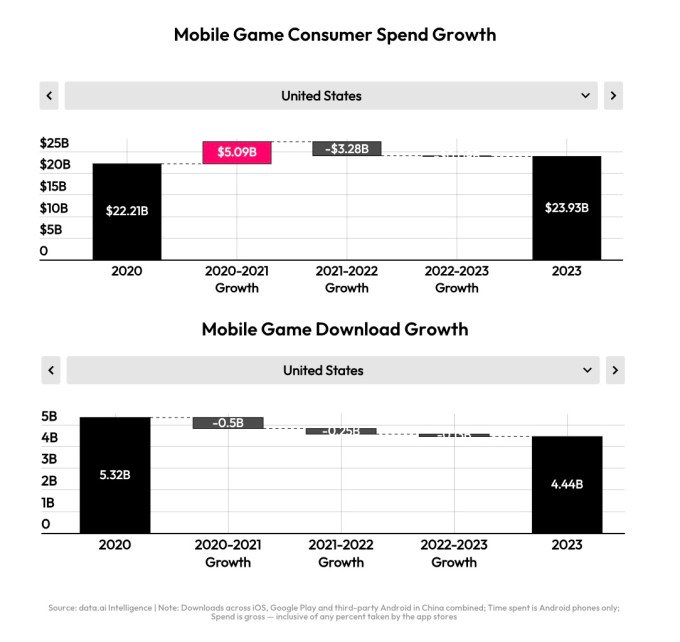

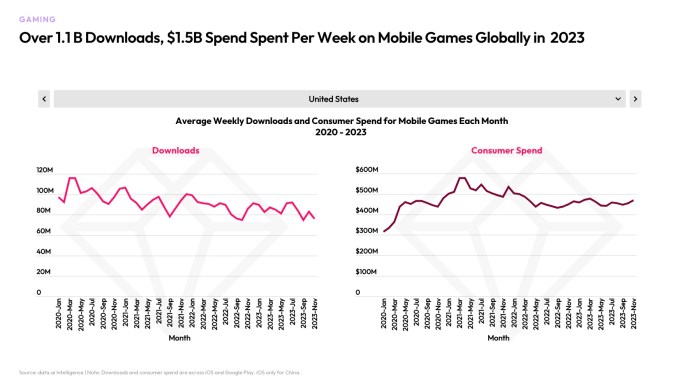

However, mobile gaming did not fare as well in 2023, with spending down 2% year over year to $107 billion. Game downloads were about the same as last year, with 88 billion of the 257 billion total downloads. Top genres included hyper-casual, simulation, and action. Some of the big hit games of the year were Monopoly GO and EA Sports FC Mobile Soccer. In another milestone, Genshin’s lifetime spending total surpassed his $4 billion mark. Games like “Block Blast Adventure Master” and “Attack Hole” grew in download numbers, among unexpected hits like “Avatar Life.” Gacha Life 2 and Eggy Party also saw a significant increase in downloads and usage.

Image credits: data.ai

Image credits: data.ai

Other trends in 2023 include Chinese shopping apps like Temu and Shein expanding into Western markets, growing by 140%, and time spent on social and entertainment apps increasing by 12% to 3 trillion hours. Ta. Spending in the latter also rose 10% to $29 billion.

Post-pandemic trends continued with a 13% increase in travel app downloads driven by travel services (26%), tour bookings (80%), and flight bookings (43%). Similarly, thanks to Taylor Swift and Beyoncé’s big concerts, ticket sales apps are up 31% and 66% from pre-pandemic levels.

The full report breaks down the top apps and games by country based on metrics such as installs, spend, and time, and separates them into financial, retail, video streaming, social, food and drink, travel, health and fitness, sports, and more. We delve into the sector in detail. .

Globally, TikTok was the top app in terms of installs and dollars spent, but Facebook remained number one in terms of time spent. The top games were Subway Surfers (downloads), Candy Crush Saga (spending), and Roblox (monthly active users).

Image credits: data.ai

Image credits: data.ai