of PHLX Semiconductor Division The index is off to a strong start in 2024, up 11% so far. This is not surprising since its main components include: Nvidia (NASDAQ:NVDA), AMD, broadcomand taiwan semiconductor manufacturing The company is already up significantly thanks to a solid earnings report. These companies artificial intelligence (AI) Chip.

However, there is one component in the PHLX semiconductor sector that has not been able to hit the gas pedal so far. micron technology (NASDAQ:MU). The memory maker’s stock price is up just 5% in 2024. However, recent developments have caused Micron stock to rise significantly. The company’s stock price rose 4% on February 26th.

Let’s take a look at why this happened and see why this semiconductor stock could rise following this development.

Supplying chips for Nvidia’s next generation AI GPU

Micron noted in a press release dated February 26 that it has begun mass production of its High Bandwidth Memory 3E (HBM3E) chip. The company added that this particular chip “will be part of the NVIDIA H200 Tensor Core GPU and will begin shipping in the second quarter of 2024.” Micron claims the HBM3E consumes 30% less power than those offered by competitors.

It’s no surprise that Micron would pick up a spot on HBM for Nvidia’s next processor. Micron noted in its December 2023 earnings conference call that its HBM3E chip is in the final stages of qualification with NVIDIA. With the acquisition of the business from Nvidia, the company appears to be on track to achieve its goal of generating “hundreds of millions of dollars in HBM revenue in fiscal year 2024.”

The good thing for Micron is that demand for Nvidia’s upcoming H200 processors is already strong. Nvidia management said in its latest earnings call that demand for its next-generation products will outstrip supply. Therefore, we cannot rule out the possibility that Micron will sell out all of its HBM3E chip production, especially considering that fellow memory manufacturer SK Hynix has already sold out its 2024 HBM inventory.

More importantly, Micron is reportedly ramping up HBM production capacity to meet growing demand for this type of memory from Nvidia as well as other customers. Reportedly, in November 2023, the chipmaker opened a new facility dedicated to mass production of his HBM3E. It’s also worth noting that Micron is working on increasing the HBM3E memory size, which could be rolled out next month.

All of this indicates that the company is on track to take full advantage of the growing demand for HBM. HBM is a highly sought-after product due to its introduction to AI processors. Market research firm Yoru Group estimates that annual revenue for the HBM market could reach nearly $20 billion in 2025, up from $5.5 billion last year and an estimated $14.1 billion in 2024. There is. By 2029, global HBM revenues are expected to soar to $38 billion.

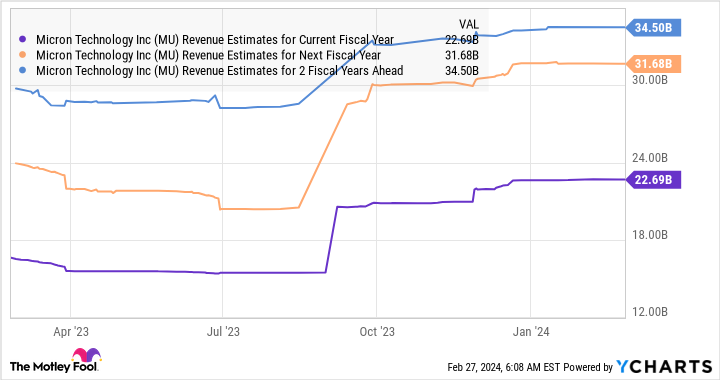

As such, Micron could potentially benefit greatly from this market in the long run, especially considering it already has an important customer in the form of Nvidia. Dominate the global AI chip market Lower your hands. Naturally, Micron’s revenue growth is expected to accelerate significantly in his fiscal years 2024, 2025, and 2026.

Stock prices may rise significantly

As the chart above shows, Micron’s revenue is expected to jump to about $23 billion in fiscal year 2024. This would be significantly higher than his $15.5 billion in fiscal year 2023. By fiscal year 2026, Micron’s sales are expected to approach his $35 billion level, which means the company’s revenue is expected to more than double in just his three fiscal years. It means there is.

Micron currently trades at 6 times sales. Although it is higher than S&P500 The index’s sales multiple is 2.8x, meaning the growth potential offered by this AI stock seems worthy of a premium valuation. This is especially true given that other chipmakers benefiting from AI adoption trade at higher sales multiples.

Therefore, if Micron Technology maintains its price-to-sales ratio of 6 in three years and actually achieves $35 billion in annual sales in fiscal 2026, its market cap could jump to $210 billion. That’s a 112% upside from current levels, so investors should consider buying this chipmaker before the stock market rally gains momentum.

Should you invest $1,000 in Micron Technology right now?

Before buying Micron Technology stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Micron Technology wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

*Stock Advisor will return as of February 26, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has Disclosure policy.

This artificial intelligence (AI) stock is about to enter a bull market Originally published by The Motley Fool